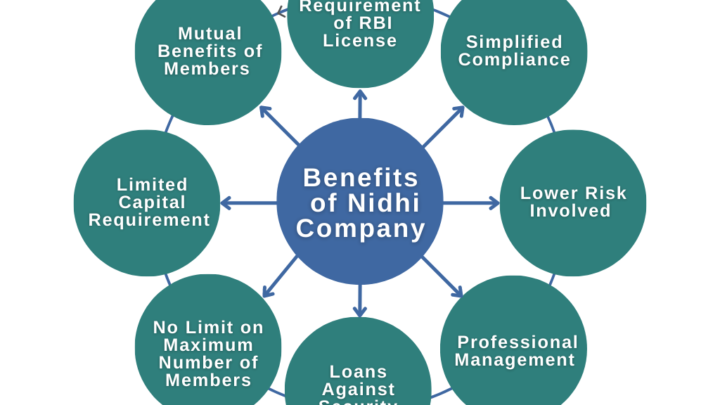

Benefits of Nidhi Company

Unlocking the Advantages of a Nidhi Company: Your Path to Financial Inclusion Table of Contents 1. Introduction Nidhi companies are a unique financial entity in India, primarily working for the benefit of their members. These companies are non-banking financial institutions that focus on promoting the habit of saving and lending among their members. Nidhi companies…